IndusInd is one of the leading private sector banks in India. The bank provides a wide range of term deposit schemes for regular individuals as well as senior citizens. In this post, I am going to tell you about IndusInd Bank Fixed Deposit scheme.

IndusInd Bank Fixed Deposit (FD)

- IndusInd Bank Limited, 2401 Gen. Thimmayya Road (Cantonment), Pune-411 001, India Tel: + 1600-609 CIN:L65191PN1994PLC076333. For any Shareholder's queries or grievances contact Mr. Raghunath Poojary at investor@indusind.com.

- IndusInd Bank online fixed deposits are as safe as the fixed deposit that you open by visiting the branch physically. The online fixed deposits are insured for up to Rs. 5 Lakhs by Deposit Insurance and Credit Guarantee Corporation (DICGC) of India, which is a wholly-owned subsidiary of the RBI.

An IndusInd Fixed Deposit is a guaranteed-return investment. The interest rates are competitive so that your money can work for you. There are various types of term deposit schemes provided by IndusInd.

IndusInd Bank fixed deposit on a short term basis has a tenure of a maximum of 30 days, and the short term fixed deposit rates in IndusInd bank is 4.50% per annum, which is compounded annually. As for long-term fixed deposits in IndusInd Bank, the maximum term of the deposit is from 1 to 5 years.

The bank provides both short term fixed deposits and long term fixed deposits. Each term deposit scheme is designed keeping in mind the different needs of customers.

Features of IndusInd Fixed Deposit

1. You can open FD account with an amount as low as Rs.10000.

2. The flexible tenure ranges between 7 days to 120 months.

3. Multiple FD schemes.

4. Flexible interest payable (monthly, quarterly, half-yearly, annually, or at maturity).

5. Partial withdrawals are allowed.

6. Auto-renewal and nomination facilities are available.

7. Convenient deposit booking through Indusnet or phone banking.

8. IndusInd Bank FD Interest Rate ranges between 3.25% p.a. to 7.00% p.a.

9. IndusInd Bank Fixed Deposit Rates for senior citizens ranges between 3.75% to 7.50% p.a.

10. You can open IndusInd Fixed Deposit online in a matter of minutes, wherever you are.

11. Open an account online by pulling funds from other bank accounts.

Safety of your Money

The deposit is insured by the DICGC of RBI for up to Rs.5 lakhs.

Eligibility Criteria

The account can be opened by individuals, HUFs, sole proprietorships, limited companies, partnership firms, societies, clubs, trusts, associations, and guardians on behalf of minors.

Documents required

If you are eligible, you need some basic documents and your application to get processed in no time. The eligibility documents include:

1. Identity proof such as PAN Card, Aadhaar card, driving license, passport, government ID, or senior citizen.

2. Address proof such as passport, electricity bill, telephone bill, bank statement with the cheque.

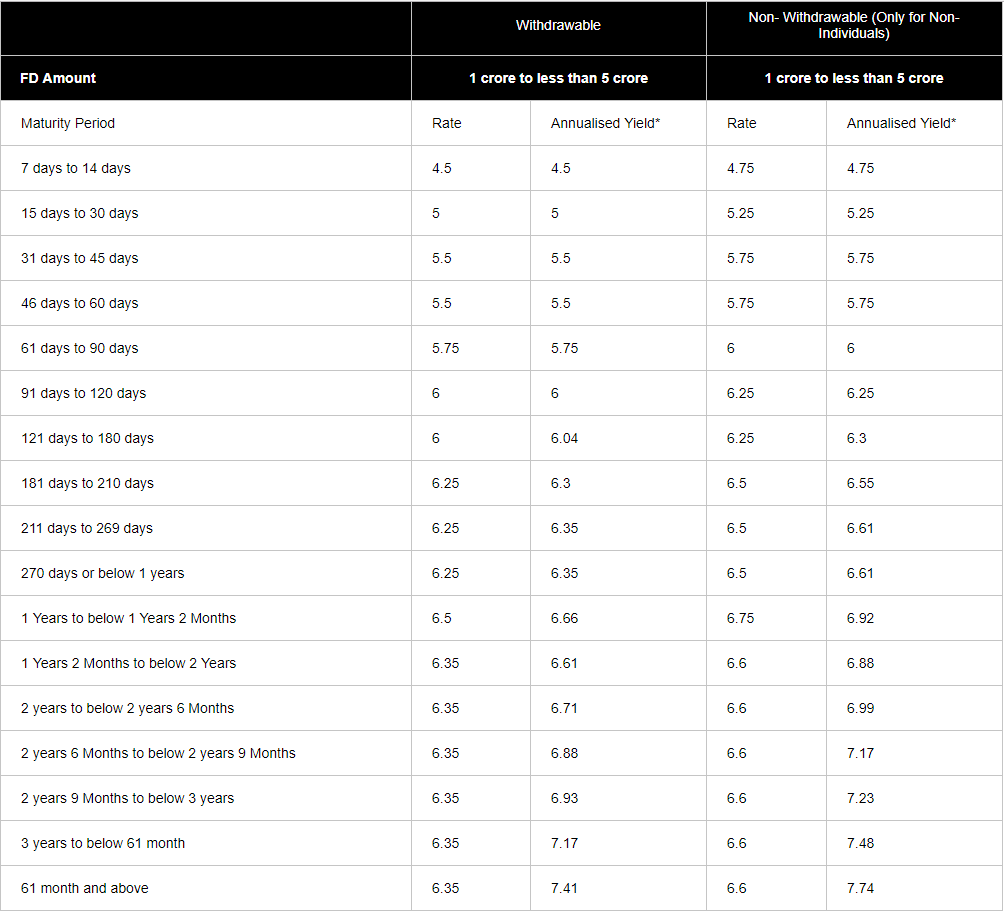

Indusind Bank Fixed Deposit Rates 2019

IndusInd FD Rates

IndusInd Bank FD Rates today ranges between 3.25% p.a. to 7.00% p.a. Senior citizens will get an additional interest rate of 0.50%. This is over and above the card rates is applicable for Term Deposits for value below Rs.2 Crore. So, interest rates for senior citizens ranges between 3.75% to 7.50% p.a.

Indusind Bank Fd Interest Rate

IndusInd Bank FD Interest Rates Today. Click here for IndusInd Bank rate of interest for FD.

IndusInd Bank FD Calculator

Find out IndusInd FD Calculator by clicking here.

How to open IndusInd Fixed Deposit?

Before you apply, do check your eligibility and have the essential documents at hand.

Existing Customers

Follow the below steps to apply for an account if you are an existing customer:

Internet Banking

1. First of all, login to IndusInd Net Banking using your internet banking ID and password.

2. Next, choose the deposit option.

3. Click on the “Create Fixed Deposit” option, fill out the form precisely.

4. On successful submission, the amount is transferred from your savings account.

5. The details are sent to your registered email Id instantly if you have registered for an e-statement. If not, a physical copy will be sent to your registered address.

Click here to open IndusInd Bank FD online.

Mobile Banking

1. Select the deposit option on your mobile banking account.

Indusind Bank Fixed Deposit Rates

2. Next, click on the “Open FD” option and fill your details.

Is Indusind Bank Safe For Fd

3. Select the amount you wish to add to your FD from your savings account.

4. The details sent to your registered email Id if you have registered for an e-statement. If not, a physical copy sent to your registered address.

Bank Branch

Visit any of our bank branches near you, along with relevant documents. The bank representatives will guide you through a simple application process.

New Customers

To open an FD account, you do not need a savings account with IndusInd. Just follow the below-mentioned steps to apply for an account if you are a new customer:

1. Visit the IndusInd Bank official website. Click here.

2. Fill out the online application form and submit it.

3. The bank representative will then get in touch with you to pick up the required KYC documents.

4. On the successful submission of the documents, your FD account will be opened.

5. The minimum FD amount for new customers is Rs.25000. If you register with an email ID, an e-statement mailed to you each month.

Indusind Bank Fixed Deposit Interest Calculator

Click here to open IndusInd Bank Online FD.

Bank Branch

Alternatively, new customers can also visit any IndusInd branches. Also carry relevant documents with you. The bank representatives will guide you through a simple application process.

Final Thoughts

Bank Deposit Rates In India

An IndusInd Bank Fixed Deposit is a guaranteed-return investment. The interest rates are competitive to give your savings a smart push. There are various types of term deposit schemes provided by the bank. So choose a scheme that is best suitable for you and enjoy great returns.

Related post: Senior Citizen Savings Scheme (SCSS): Features, Benefits & Eligibility

Related post: Top 6 Best Safe Investment Options in India